Corporate haven (redirect from Corporate tax haven) S. corporates execute tax inversions (see § Bloomberg Corporate tax inversions). Since the first U.S. corporate tax inversion in 1982, Ireland has received... 213 KB (19,767 words) - 15:39, 26 April 2024 |

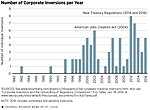

legal headquarters from a higher-tax home jurisdiction to a tax haven by executing a tax inversion. A "naked tax inversion" is where the corporate had little... 241 KB (24,843 words) - 00:14, 1 May 2024 |

| Medtronic (category Tax inversions) low corporation tax regime. Medtronic's tax inversion is the largest tax inversion in history, and given the changes in the U.S. tax-code in 2016 to block... 54 KB (4,640 words) - 17:45, 22 April 2024 |

Restaurant Brands International (category Tax inversions) various sheltering techniques to reduce its tax rate to 27.5%. As a high-profile instance of tax inversion, news of the merger was criticized by U.S. politicians... 17 KB (1,519 words) - 15:48, 10 March 2024 |

of tax burden to non-citizens or non-residents). The tourist industry typically campaigns against the taxes. It is separate from value-added tax and... 10 KB (1,028 words) - 21:33, 11 April 2024 |

of companies includes only publicly traded companies, also including tax inversion companies. There are also corporations having foundation in the United... 25 KB (209 words) - 23:29, 15 April 2024 |

A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale... 103 KB (13,736 words) - 21:28, 26 April 2024 |

Mallinckrodt (category Tax inversions) headquartered in Ireland for tax purposes, its operational headquarters are in the U.S. Mallinckrodt's 2013 tax inversion to Ireland drew controversy when... 49 KB (4,942 words) - 18:48, 22 April 2024 |