Corporate taxes in Canada are regulated at the federal level by the Canada Revenue Agency (CRA). As of January 1, 2019 the "net tax rate after the general...

33 KB (3,846 words) - 07:32, 30 May 2022

Canada's federal income tax system is administered by the Canada Revenue Agency (CRA). Canadian federal income taxes, both personal and corporate income...

36 KB (3,533 words) - 15:01, 14 April 2024

A corporate tax, also called corporation tax or company tax, is a type of direct tax levied on the income or capital of corporations and other similar...

51 KB (5,721 words) - 15:52, 29 April 2024

Corporate tax is imposed in the United States at the federal, most state, and some local levels on the income of entities treated for tax purposes as...

62 KB (6,533 words) - 05:13, 21 October 2023

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for...

213 KB (19,768 words) - 07:38, 23 May 2024

global minimum corporate tax rate, or simply the global minimum tax (abbreviated GMCT or GMCTR), is a minimum rate of tax on corporate income internationally...

39 KB (4,278 words) - 10:27, 27 April 2024

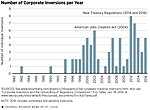

A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign...

92 KB (9,812 words) - 21:45, 1 January 2024

Young (2011). "Group Relief for Canadian Corporate Taxpayers–At Last?". Canadian Tax Journal. 59 (2). Canadian Tax Foundation: 239–263. Archived from...

61 KB (6,318 words) - 06:58, 16 November 2023

groups in each country and sub-national unit. The list focuses on the main types of taxes: corporate tax, individual income tax, and sales tax, including...

137 KB (5,471 words) - 16:20, 21 May 2024

traditional tax havens and major corporate tax havens. Corporate tax havens often serve as "conduits" to traditional tax havens. Use of tax havens results in a...

240 KB (24,696 words) - 18:24, 16 May 2024